Commercial Property Valuation Methods

6/20/2023

Property Valuation

Struggling to determine the true value of your property in Canada's ever-changing real estate market?

If so, you're not alone. According to recent statistics, the Canadian commercial real estate market is anticipated to increase at a CAGR of over 8% in the coming years.

Many Canadian commercial real estate (CRE) owners like yourself find themselves worried about underselling their assets. The good news is that there are specific CRE valuation methods you need to know about to ensure you get the best deal possible.

In this article, we'll explore these methods in detail, empowering you to accurately assess and maximize the value of your property.

So, without further ado, let’s get started!

Why is CRE Valuation Important?

CRE valuation helps property owners, and investors determine the fair market value of their assets so they do not undersell their property and get maximum ROI. It plays a vital role in assessing the worth of properties used as loan collateral.

Moreover, accurate and up-to-date valuations provide buyers, sellers, and investors with transparency and confidence, which is beneficial to the industry's overall growth.

Factors to Consider During Commercial Property Value Calculation

Let's say your CRE value was $1 million last year, but this year it rose to $1.5 million; so what changed during this time? Here are 3 major factors that can affect your commercial property's value:

Cap Rates

The income capitalization method compares the value of a property to similar properties in the same market based on its net operating income (NOI).

For example, if office buildings in Vancouver have a cap rate of 6% and a comparable office property generates an NOI of $500,000 per year (before debt service), the income capitalization approach would value the building at $8,333,333 ($500,000 NOI / 6%).

Utility

Commercial utility means the more useful a property is, the greater its value. To understand this, let's look at an example of two restaurants available for rent.

Restaurant A is in a busy downtown area with lots of foot traffic and a spacious interior. In contrast, restaurant B is located in a less busy area and is far from the city center. In other words, Restaurant A has a higher utility value than Restaurant B.

So you see, the utility of a commercial property is directly linked to its valuation.

Supply and Demand

CRE supply refers to the number of properties available for sale or lease in a given area. In contrast, real estate demand refers to the number of buyers or tenants seeking properties in that area.

When the supply of CRE is limited and its demand is high in a particular area, property value tends to increase. Due to less availability, buyers and tenants may be willing to pay more.

Likewise, if there is an abundant supply of commercial real estate, but its demand is low in an area, property value decreases. Market conditions like supply and demand can also significantly impact your property's value.

Top Commercial Property Valuation Methods

Here are the top 6 commercial property valuation methods used in Canada.

1. Cost Valuation

Cost valuation is a fundamental method used to determine the value of commercial properties. It involves estimating the cost required to rebuild the property from scratch.

This approach is particularly useful when the property has undergone specialized improvements that significantly enhance its value.

The cost valuation method considers several factors involved in the reconstruction or rebuilding of the property. These include land value, construction costs, labor expenses, the price of materials, and other additional expenses.

However, this method does not capture other important aspects of the property, such as market demand and potential income.

2. Sales Comparison

In sales comparisons, recent sales of comparable commercial properties serve as benchmarks for determining your property's market value.

Commercial real estate agents take into account the age, condition, location, lot size, building size, number of units, square footage, type of construction, and the specific commercial sector.

In addition, they also consider any specialized improvements and make pricing adjustments accordingly. Your property value can be calculated once a comparable price per square foot is determined. Following is the formula:

3. Gross Rent Multiplier

The gross rent multiplier (GRM) valuation method is commonly used in the Canadian real estate market. This method uses gross rent revenue to estimate the value of a commercial property.

It can give us a metric to calculate how much a property is worth. Still, it doesn't consider the property's location and maintenance. So, using the GRM along with other methods is best to get a more accurate picture.

You need to know how much gross rent a property generates annually and the GRM of comparable properties. Calculating the gross rent multiplier (GRM) is simple.

Divide the price of your property by its gross annual income. The outcome provides a metric that you can use to assess similar commercial properties in a specific market.

4. Cost per Door

The cost-per-door method is primarily used for multi-unit complexes or apartment buildings that generate rental income. It calculates the property's value based on the cost per individual unit, or "door."

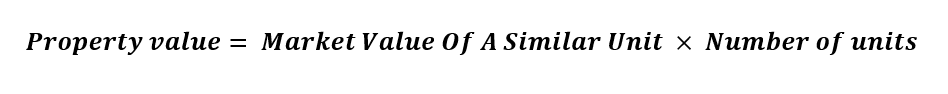

To determine the property's value, use this formula:

For example, if the apartment building as a whole is valued at $5 million and there are 50 units, the average value per door would be $100,000. However, it does not account for differences in unit types, occupancy rates, or other property-specific factors.

5. Income Capitalization

Income capitalization focuses on a property's income potential over its physical features. It is typically used to estimate the value of income-producing properties such as shopping centers, office buildings, and apartment complexes.

Income capitalization follows a simple yet powerful principle: the value of a commercial property is directly proportional to its income-generating capacity.

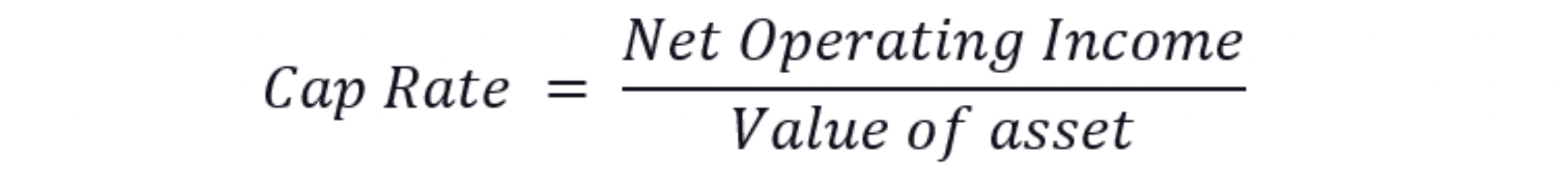

The method uses a capitalization rate, which is the expected return on investment. You can determine a metric CAP Rate by dividing your property’s net operating income (NOI) by its market value.

6. Cost per Rentable Square Foot

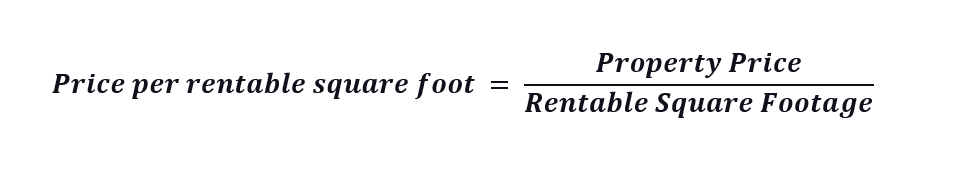

In this CRE valuation method, the rentable square footage is subtracted from the total square footage of the property, and the cost per rentable square foot is compared to the average lease rate.

For instance, if a $5 million office building has a total of 20,000 SF and 3,000 SF is used for common areas, then the price per rentable square foot is $294 ($5 million divided by 17,000 SF).

You can then get an estimate of the gross rental income by looking at the current market rent and comparing it to the cost per rentable square foot of the property.

Final Thoughts

So, whether you're selling, buying, or just leasing, knowing a commercial property's accurate market value is crucial. After all, commercial real estate is a huge investment, and you cannot risk it at any cost. The above methods will surely guide you in calculating a fair value for your property.

However, if you're still unsure about determining the value of a commercial property, you can utilize a free commercial real estate valuation calculator. Focused Industrial offers an Advanced Complimentary Valuation Tool that takes into account important commercial features influencing your property's value.

By entering detailed property information into the calculator, you can effectively analyze your commercial properties and receive commercial real estate valuation results within 24 hours.